2020 is in the books! How did you do? With the new year just beginning, now is the perfect time to look at your P&L and Balance Sheet to check the health of your business. I also recommend that you run your Profit Assessment, as well. Even if you did this earlier in the year, run it again. Sometimes the “paper” profit on our P&L doesn’t leave us with money in our bank account. Last month we talked about the difference between cash and profit. With Profit First, we want the “paper” to be paper money, true cash available to reward you for your efforts. So, let’s pull your year-end financials and see where you stand.

How to Start

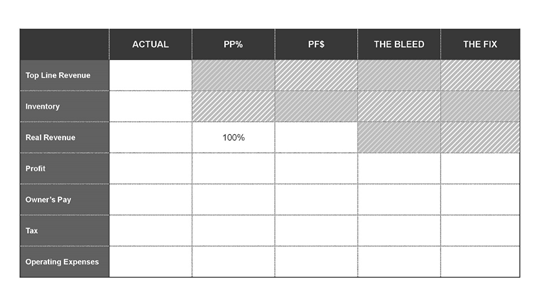

Using the chart below as a guide, create one of your own to use as you plan your upcoming year. Follow the steps to complete the Actual column on the chart.

Step 1. Determine your Top Line Revenue. This is easy. Pull the number from your P&L. It is your total income for the business; the total sales on Amazon and all other platforms, before fees.

Step 2. Do a little math. First, find the COGS number from your P&L. This should include the cost of your product, Amazon fees or other merchant processor fees. Second, look at your Balance Sheet. Pull your balance sheet for the end of 2017 and the end of 2018. Subtract the inventory balance in 2017 from the 2018 balance. This is the change in the inventory account for the year. Add this to your COGS number and it goes in the 2nd box.

Step 3. Calculate your Real Revenue. Subtract your COGS/Inventory from your Top Line Revenue. This is the amount you can contribute to your Profit, Owners Pay, Taxes and Operating Expenses. Let’s get to them next.

Step 4. Calculate your Profit. This is also a calculated amount and it comes from your Balance Sheet – not your Profit & Loss report. The number on your P&L report is the “paper” profit. Let’s get to the meaningful number. On the Balance Sheet, take 2018 bank balances and subtract 2017 bank balances. Do the same for your loans and credit cards. 2018 less 2017 will give you the change that occurred in 2018. Take the calculated amount for your bank accounts and subtract the calculated amount for your loan and credit cards. This difference is your profit. I hope it’s positive, but don’t be alarmed if it’s negative. The negative number means you are using credit in your business.

Step 4. Determine the total amount you paid yourself. Did you take a salary? It will show up as Salary, Wages or Payroll, possibly with your other employees. Perhaps you took an Owner Draw. You can find this on the Balance Sheet. Take the difference between 2018 and 2017. That is the amount of draw for the year. One final consideration—If you contributed money to the business, you need to calculate the difference between 2017 and 2018 and reduce the amount of your draw by the amount of your contribution. The equation would look like this: Salary + (Owner Draw (2018-2017) – Owner Contribution (2018-2017)). This is the amount for the Owner Pay box.

Step 5. Record your estimated Tax payments. If you have made estimated tax payments for the business, record these in the tax box.

Step 6. Determine your Operating Expenses. Operating expenses are found on the P&L. Make sure you start with the total expenses and remove any owner pay that may show up in wages. In some cases, I’ve seen estimated taxes recorded on the P&L. Be sure you have removed anything showing up in one of the other buckets from the number you use.

Make the Comparison

OK, the moment of truth—Do you balance? If you don’t, check your math signs. Sometimes the subtraction can throw you off.

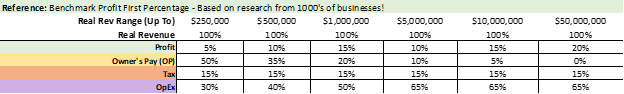

Once you balance, compare your Actual Colum with the Profit First Percentages below based on your Real Revenue. This chart was created by Mike Michalowicz based on evaluating 1000’s of successful businesses. This is your opportunity to compare to a benchmark! Plug in the appropriate percentages into the second column—PP%. Then complete the third column, the PF$. Take your Real Revenue number and multiply it by the PP% to get the PF$. Once you have this column complete, you can see how your actual performance compares to the recommended PF performance.

The Bleed

Finally, it’s time to complete the column called The Bleed. This is simply the PF% column less the Actual Column. The difference is the opportunity to improve. The fix column is where you can document this opportunity. Do you need to increase, maintain, or decrease your actual performance to meet the Profit First Benchmark?

When you’re done, based on what your numbers show, use this information to make your plan for 2019. Do you need to cut operating expenses? Are you paying yourself? What steps do you need to take in your business to be permanently profitable? Prepare now and set yourself up for a great year!

Want to book an appointment? Contact us now!

Interested in Profit First for Ecommerce Accounting?

You can also sign up for the Profit First for Ecommerce Sellers Online Course. As a Mastery Level, Certified Profit First Professional, I will teach you why Profit First works so well for ecommerce businesses and the particular challenges for businesses that have physical products requiring inventory management. You will learn how your behavior drives your money management habits for your business and how you can set up your business bank accounts to work with your habits. Contact bookskeep today to learn more about ecommerce bookkeeping and accounting.

Leave a Comment